Deferred revenue arises because of the accruals basis of accounting, which states that revenue should be recorded in the profit and loss across the period to which is relates.

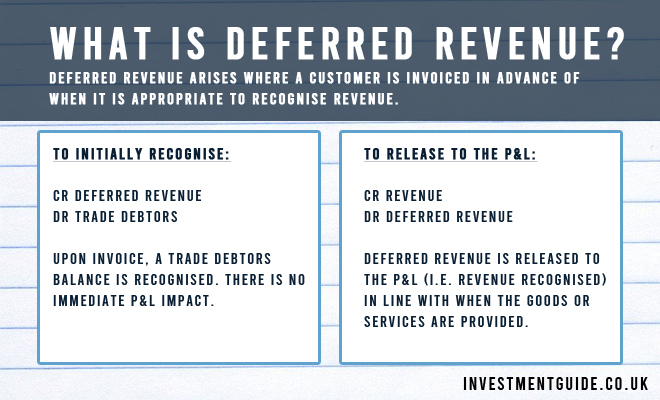

Where a customer is invoiced in advance of when it is appropriate to recognise revenue for goods or services, deferred revenue arises.

Deferred revenue is a contract liability. This is because it represents the obligation you have to deliver the goods or service to the customer.

Deferred revenue example – accounting double entry

To create a deferred revenue balance once an invoice has been raised, the accounting entry is Cr Deferred Revenue, Dr Trade Debtors.

If we imagine that this deferred revenue relates to an annual subscription, the revenue would be recognised evenly across that year.

Revenue is recognised over this time period through the accounting Cr Revenue Dr Deferred revenue.

Separately, the invoice is likely to be settled sooner. For instance, the invoice may be due within 60 days from the date of issue. When cash is received to settle the invoice, the accounting double entry would be Dr Cash, Cr Trade Debtors.

Typical analysis prepared on deferred revenue

When performing due diligence on a business, there are a few different ways you would typically seek to analyse deferred revenue.

- Obtain a breakdown of deferred revenue by revenue type

- Creating a breakdown of deferred revenue by revenue type allows you to confirm your understanding of which types of revenue are typically billed in advance.

- Obtain a breakdown of deferred revenue by customer

- Creating a breakdown of deferred revenue by customer allows you to gain an understanding of which customers are driving the deferred revenue balance.

- Perform deferred revenue run-off analysis

- Deferred revenue run-off analysis involves taking the deferred revenue balance at the latest balance sheet date and charting the expected unwind profile. This analysis helps you to visualise the typical advance billing profile of the business. Further, it allows you to see any outliers (i.e. customers who have prepaid for an extra-long period of time). This is important as it is these balances which could be argued as being more debt like in nature rather than working capital (as the business has received cash up front but must continue to service the agreement for the life of the contract) during transaction share purchase agreement negotiations.

- Deferred revenue days analysis

- Unlike debtor days and creditor days which are calculated on a count-back basis, deferred revenue days should be calculated on a count-forward basis using revenue as the driver, given deferred revenue converts to future revenue. This analysis is infrequently used by due diligence providers but can sometimes be useful as an indicator of whether there has been any significant shift in the advance billing profile.

Treatment of deferred revenue in share purchase agreements

The treatment of deferred revenue in transaction share purchase agreement negotiations can often be a contentious area.

The sell-side view is that deferred income should be treated as working capital, whereas the buy-side may try to argue that deferred income should be treated as net debt.

Generally speaking, trying to argue that deferred income should be treated as net debt is not fruitful unless it can be shown that deferred revenue is abnormal (i.e. is not a typical feature of the business or will not be replaced in future).

For example, lets imagine a business normally bills annually in advance for services but billed one of its customers for five years in advance.

Day 1

Customer is billed £1m for five years of software support. The accounting entry posted is Cr Deferred Revenue £1m Dr Trade Debtors £1m.

Day 60

Customer settles its £1m bill. The business receives £1m cash. The accounting entry is Dr Cash £1m, Cr Trade Debtors £1m. At this point, the business has £1m in cash, but must now provide services to its customer for the remainder of the five year contract period.

End of year

By the end of the first year, the business has recognised £200k of revenue as one year of software support has been provided. The accounting entry will be Dr Deferred Revenue £200k, Cr Revenue £200k.

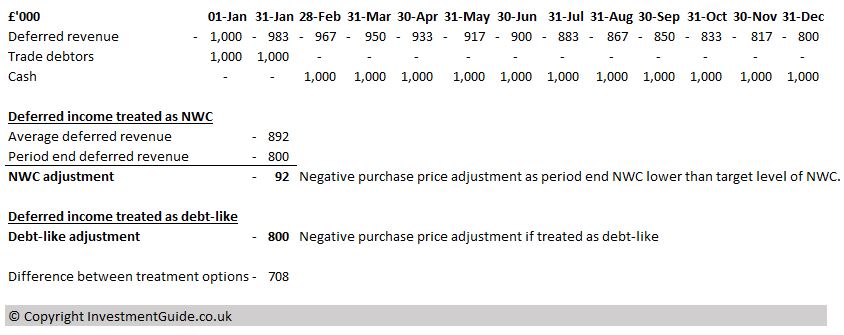

At this point, the remaining deferred revenue balance is £800k. The average deferred income balance across the year (taking month-end values) has been £892k.

Locked box consideration

If we assume the year-end is our locked box date, the treatment of deferred revenue will make a significant difference to the purchase price adjustments made in the enterprise to equity value bridge.

If deferred revenue is treated as net working capital, there would be a negative purchase price adjustment of £92k. This is because the year-end balance of £(800)k is £92k higher than the £(892)k average balance across the last twelve months. Where working capital is higher than the target working capital level, a negative equity value adjustment arises.

Conversely, if the year-end deferred income was treated as a debt-like item, there would be a £800k negative purchase price adjustment (i.e. a further £708k off the equity value). The purchaser would argue for this adjustment where there is material uncertainty about the customer renewing on similar terms going forward. Why? Because the business will receive no further cash from the customer but will be contractually required to service the contract for the remaining four years.