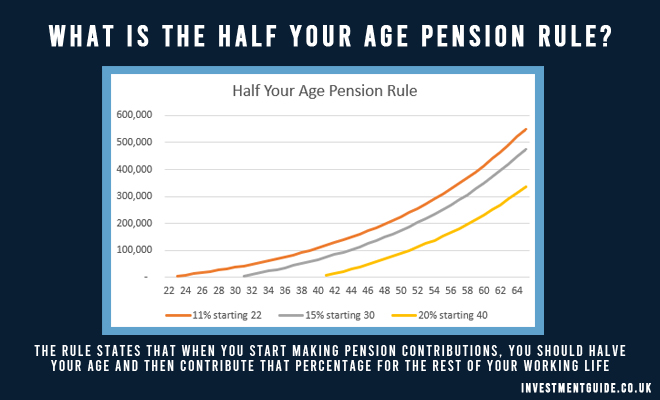

The ‘save half your age’ pension rule of thumb is commonly cited by financial advisers. This rule states that when you start making pension contributions, you should halve your age to derive the percentage you will contribute into your pension pot each year until you retire. This percentage refers to the combined contribution of both employer and employee.

The rule is intended to simply convey the point that the earlier you start contributing funds into your pension scheme, the more time those funds will have to grow and benefit from tax free compound growth.

Consider this simplistic example to illustrate the power of time in the market.

If you are 30 and you invest £10,000 in your pension today, assuming 8% growth, you would have £100,626 at age 60. If you waited to invest £10,000 at age 40, the fund would be worth just £46,609. You would actually need to increase your investment to £21,589 at age 40 in order to have the equivalent £100,626 at age 60.

Does the ‘half your age’ strategy make sense for everyone? No. Is it better than nothing and useful as a starting point for your thinking? Yes.

What is the best strategy to build a pension pot for retirement?

Rather than simply aiming to contribute half your age, you should be considering:

- How much you can afford to contribute now. Good habits last a lifetime and if you start making pension contributions early, you won’t feel the pinch/have to play catch up later on down the line. The ‘save half your age’ rule is useful in illustrating the importance of this point.

- Your marginal rate of tax. If you are a higher rate taxpayer, then any contributions you make into your pension up to the annual allowance will attract tax relief. This means you won’t be handing over 40% of your salary to HMRC in income tax. The point at which you start paying 40% tax is the point you should really be thinking hard about whether you need the money now or whether it can be set aside for your future.

- Your employees policy in regards to matching pension contributions. Some companies have very attractive pension schemes whilst others will just adhere to the statutory minimum employer contributions. If you are 20 years old, the half your age pension rule would advocate a 10% pension contribution each year (from both employer and employee contributions). However, if your employer offers a 6% contribution match and you only take them up on 5%, you would effectively be leaving free money on the table.

- The age at which you hope to retire and the standard of living you want in retirement. The ‘save half your age’ pension rule is a guide for a ‘comfortable retirement’ based on the standard pension age. If you want to retire young or want a more than comfortable retirement then it stands to reason that you should invest more into your pension plan.

- If you are fortunate enough to be in a position where you may exceed the Pension Lifetime Allowance on retirement, this should also factor into your thinking. Clearly pension tax rules can change, but it is prudent to plan based on what we know now.