Revenue is simply the amount that a company makes from selling its products and/or services to its customers. Within the profit and loss, revenue is the ‘top line’.

Revenue is also known as ‘sales’ or ‘income’, so don’t get confused by the different terms used.

Revenue recognition

Revenue should not be confused with cash receipts from sales.

Under the ‘accruals basis of accounting’, revenue represents the amount earned or delivered in a specific period and is recognised in accordance with the applicable accounting standard.

As a simple example of this, if a retailer sells you a television in December, but allows you to pay in January, it would recognise revenue in December (Cr Revenue, Dr Trade Debtors) and then release its debtors balance in January when you pay the balance (Cr Trade Debtors Dr Cash).

Accounting double entry

To recognise revenue, the double entry will be either:

- Cr Revenue Dr Cash – Where you recognise revenue immediately upon sale and the customer pays in cash.

- Cr Revenue Dr Trade debtors – Where you recognise revenue immediately upon sale and the customer pays on account (i.e. does not need to pay immediately).

- Cr Revenue Dr Deferred Income – Where you have already invoiced a customer in advance (Dr Trade Debtors Cr Deferred Income) and are now releasing the deferred income to the profit and loss. For example, you might release revenue over time as services are performed.

- Cr Revenue Dr Accrued Income – Where you are recognising revenue in advance of issuing an invoice.

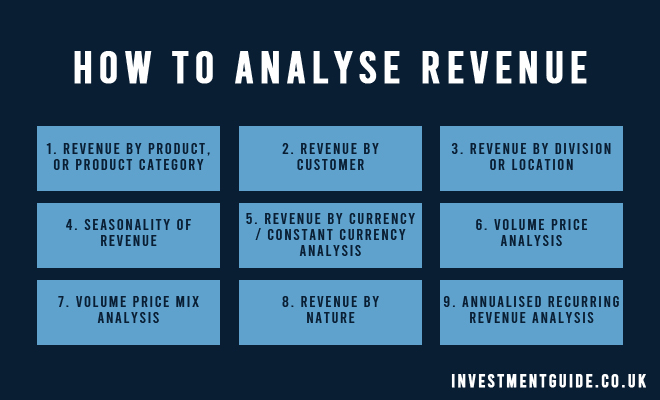

Revenue analysis

When performing financial due diligence, one of the most important scope items is analysing and understanding revenue trends.

The typical types of revenue analysis performed are:

Revenue by product or product category

Revenue is generated from the sale of products or services and therefore understanding the trends in revenue from products or services is extremely important.

Pulling together a table which shows revenue by product is a great starting point for a conversation with Management and can help you to understand:

- What the key products of the business are and the level of reliance on those products

- Number of different products/SKUs sold

- What is driving revenue trends for individual products (i.e. price/volume impact)

- Level of reliance on new product launches vs. established products

- Identify products which are protected by patents/trademarks

- The nature of services offered

Revenue by customer

It’s only possible to have revenue if you have customers willing to pay you for goods and/or services. Customer relationships are therefore paramount to business success.

A table showing total revenue by customer in each relevant period is the best starting point for discussions with Management re: customer revenue trends.

This analysis can help you to understand:

- How revenue by customer has changed across the historical period under review.

- What is driving revenue movements – price/volume or mix of product sales?

- Whether there is any customer concentration risk (i.e. whether the business is overly reliant on one or a small number of customers for a significant proportion of its revenue)

- How ‘sticky’ customer relationships are – looking at customer tenure can be useful as support.

- Recent customer wins and losses and drivers. Depending on recent experience of wins/losses, the forecast case may be strengthened or weakened.

Revenue by division/location

Sometimes it’s possible to get lost in the detail of individual product or customer trends.

Analysing overall performance at a divisional or geographical level can help you to get a better view of high-level revenue trends. It is typically advisable to analyse based on how Management segments business performance. By following this approach, Management are more likely to be able to speak to the trends.

Revenue seasonality

By charting year-on-year revenue (either in totality, or for a certain type of revenue) on a simple line graph, you can see whether it is likely that business experiences seasonality.

Peaks/troughs in revenue can also be caused by other factors (e.g. a one-off large sale), but such analysis is the most useful starting point for a discussion with Management about seasonal influences.

Revenue by currency

It’s important to understand the currency that a company uses to invoice its customers as this will help you to understand the exposure to foreign exchange rate movements.

By obtaining this information and combining with average foreign exchange rates, it is possible to produce indicative constant currency analysis to see whether reported revenue trends are being distorted by foreign exchange rate fluctuations.

Volume / Price / Mix analysis

If you are looking at a single product sold to a single customer in isolation, there are only two factors which can result in changes to the level of revenue: Volume and Price.

Changes in revenue can only be driven by one or both factors.

However, if you are looking at volume and price movements across multiple products sold by the business, you also need to consider mix. Mix refers to a change in the composition of what you are selling.

Mix is important because if you conduct price volume analysis on total revenue, you may see a positive volume impact and negative price impact. However, this negative price impact may arise because the business has started selling more of a cheaper product, rather than there being genuine price reductions across the product range.

Read our price volume mix bridge analysis article here for further details.

Revenue by nature

The nature of the revenue is an important consideration and can have a significant impact on company valuation.

The ‘nature’ of revenue refers to whether it is contractually recurring in nature, repeatable in nature or non-recurring in nature. For example, many SaaS businesses generate contractually recurring revenue and thus generate high valuations.

A business generating high contractually recurring revenue will generally be worth more than a business that has to go out and win new work every year to achieve the same level of revenue as the prior year.

This is because provided you can keep your customers happy and have low churn rates, securing more customers whilst retaining your existing base can result in strong revenue and profitability growth rates. See our related article on ‘customer lifetime value’.

Annualised recurring revenue (ARR) analysis

If a business has a large recurring revenue base, the period end annualised recurring revenue is typically regarded as a better indicator of current performance than the most recent full year revenue.

ARR analysis will typically be based on the latest month’s revenue * 12.

The opening ARR of FY02A would be equal to the closing ARR of FY01A, which would represent 12 * December FY01 revenue (assuming a December year end).

The bridging items represent the annualised impact of each factor:

- Churn is where a customer is lost (or notified as lost, depending on definition used).

- Upsell is where an existing customer adds additional users or services driving an increase in recurring revenue.

- Downsell is the opposite of upsell (i.e. a customer reduces users of services) and drives a decrease in recurring revenue.

- New customer revenue is calculated as the annualised impact of new customers secured in the year.

Each of these bridging items can be divided by opening ARR to generate the KPIs shown (e.g. churn %).

Net retention rate is the ARR prior to the impact of new customer wins. It is a frequently used metric to measure whether the ARR based on the existing customer base only is growing or retracting.