Gold is commonly regarded as a ‘safe haven’ asset. This is driven by the fact that on numerous occasions, gold prices have fared better than equity and debt markets in times of market turbulence. For example, the FTSE 100 fell from £73.03 on 21 February 2020 to a low of £49.93 on 23 March 2020 (a reduction of £23.10 or 31.6%) in response to the coronavirus pandemic. Over the same time period, gold rose from £1,262 per oz to £1,297 per oz (an increase of £35 per oz, or 2.8%). As a result, private investors commonly invest in gold as part of a wider investment portfolio to increase the stability of returns.

But it’s not just private investors investing in gold. In fact, over 34,000 tonnes of gold was held in reserve by the richest countries in the world at the end of March 2020. The UK, for example, holds $175,122 million in reserve assets, of which $16,042 million is held in gold (source: Bank of England UK International Reserves data, March 2020).

Carry on reading to understand what gold is used for, why people/countries invest in gold, where its mined, and how recent supply and demand trends have impacted gold prices. Finally, we will summarise the various ways you can invest to gain exposure to the gold market.

- What is gold used for?

- Why do countries hold gold reserves?

- Where is gold mined?

- Gold supply vs. demand

- Historical gold prices

- How to invest in gold

What is gold used for?

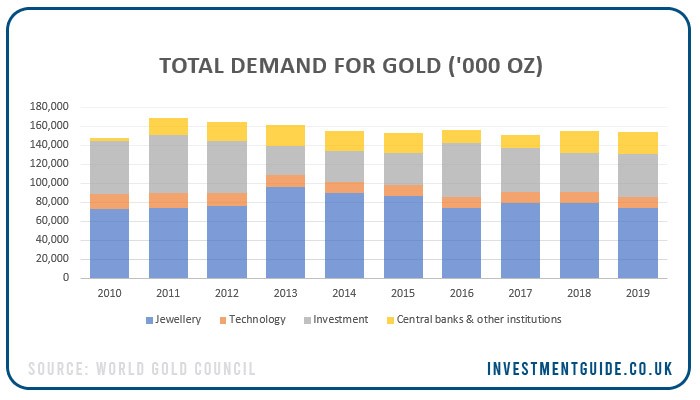

Throughout history, most established cultures have considered gold as a status symbol, symbolising power, beauty and accomplishment. Modern society is no different and gold mined today is primarily used in the creation of jewellery (48.4% of demand in 2019). Aside from jewellery, the remaining demand is largely attributable to demand from private investors and central banks for investment purposes or to hold as foreign exchange reserves, respectively.

Gold also has a number of special qualities which make it useful for industrial applications. For instance, it conducts electricity, does not tarnish, can be easily manipulated, can be melted/cast and can be used to create alloys with many other metals. However, the proportion of gold mined which is used in industry is relatively small, which can be partially explained by the relatively high price of the commodity. In 2019, 7.5% of total demand was attributable to technology – see below for further detail.

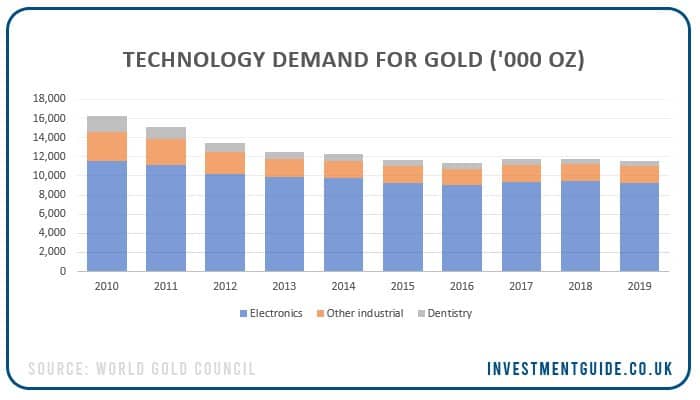

- Electronics – Gold is essential for computer electronics and satellite communication technologies. A minute amount of gold is used in the vast majority of sophisticated electronic devices. Gold is commonly used as it is highly averse to corrosion and is an excellent conductor of electricity. For example, Apple has a line of disassembly robots it calls Daisy. In its 2019 environmental report, Apple declared that 1.1kg of gold is recovered by ‘Daisy’ for every 100,000 iPhone devices it recycles.

- Dentistry – Gold is typically mixed with other metals to form a gold alloy which is commonly used in conservative and restorative dentistry, as well as in orthodontics.

- Other industrial uses – Gold has a variety of other industrial uses. A few examples include gold use in glassmaking and gold use as a lubricant between mechanical parts in space shuttles.

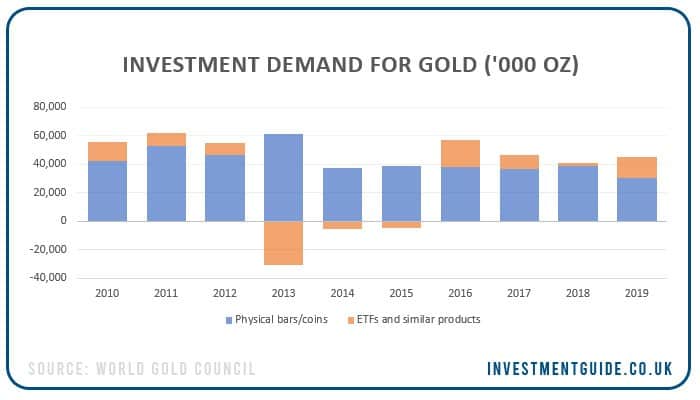

Investment demand for gold can be split into two categories: 1) demand for physical gold bullion bars/coins, and 2) demand for exchange traded instruments. See the ‘how to invest in gold‘ section for further detail on both investment choices.

Why do countries hold gold reserves?

Many countries hold gold reserves as part of their wider foreign exchange reserves. The official holdings of the countries with the largest gold reserves are listed below:

| Country | Tonnes of gold held (April 2020) |

|---|---|

| USA | 8,133.5 |

| Germany | 3,366.5 |

| IMF | 2,814.0 |

| Italy | 2,451.8 |

| France | 2,436.0 |

| Russia | 2,290.2 |

| China | 1,948.3 |

| Switzerland | 1,040.0 |

| Japan | 765.2 |

| India | 635.0 |

Official holdings comprise 17.2% of all above-ground gold supplies, with the vast majority of mined gold used in jewellery. The table below from the World Gold Council shows where all known above-ground gold stock is used.

| Above-ground gold stocks (tonnes) | 2019 (tonnes) | % of total |

|---|---|---|

| Jewellery | 92,947.3 | 47.0% |

| Official holdings (i.e. foreign currency reserves) | 33,919.2 | 17.2% |

| Private Investment | 42,619.4 | 21.6% |

| Other fabrication and unaccounted | 28,089.7 | 14.2% |

Common reasons for holding gold investments as part of international reserves are:

- No default/solvency risk – Gold is a physical asset which cannot be frozen, repudiated or defaulted on. There is effectively no credit or counterparty risk involved.

- Diversification/stability – Gold is often held as part of a wider portfolio of investments as a store of value. The inclusion of gold as part of a wider portfolio of assets tends to increase the stability of the value of foreign exchange reserves as the value of gold typically does not follow the same pattern as the value of currency reserves.

- Liquidity during financial crises – Gold typically maintains strong liquidity during financial crises, whereas it can be difficult to find willing buyers for alternative financial assets.

- Emergency reserve – Gold is seen as an emergency reserve which could be pledged as collateral or sold if the home currency comes under pressure.

- Limited resource / imperishable – There is a limited supply of gold in the world and gold is imperishable meaning it can be held in perpetuity.

- Constitutional requirements – The constitutions of certain countries (e.g. Switzerland) demand that gold forms part of total foreign exchange reserves.

- Historical reasons – Across the world, gold has historically been seen as the ultimate backing for domestic currency.

Where is gold mined?

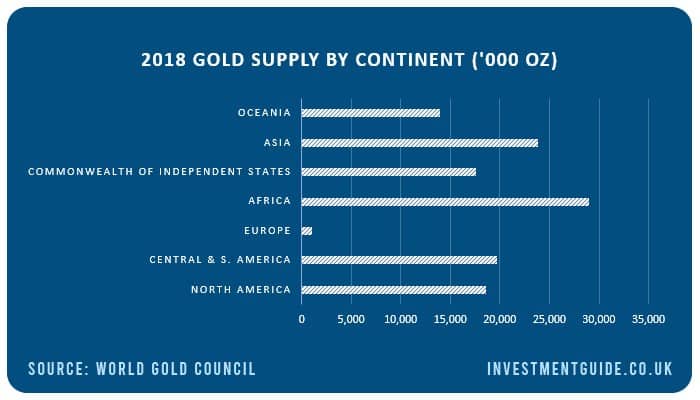

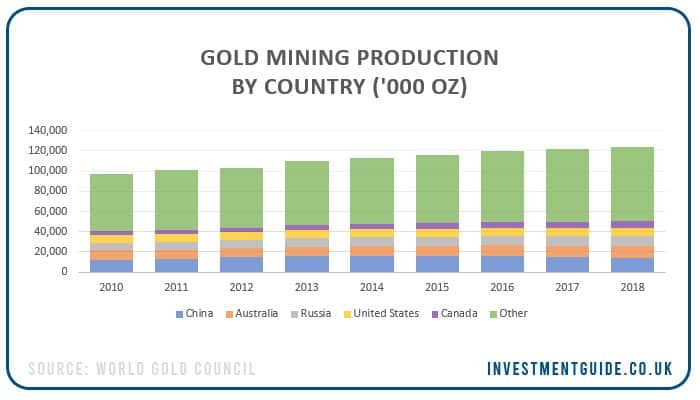

Unlike platinum where just two countries produce over 80% of all supplies, no single country or continent holds a monopoly over the gold mining industry. A significant amount of gold is mined across each continent, with Europe boasting the smallest output.

The gold mined in the top five gold mining countries around the world (China, Australia, Russia, USA, Canada) comprised 41% of all gold mined in 2018, but the remaining 59% is mined by a long tail of other countries.

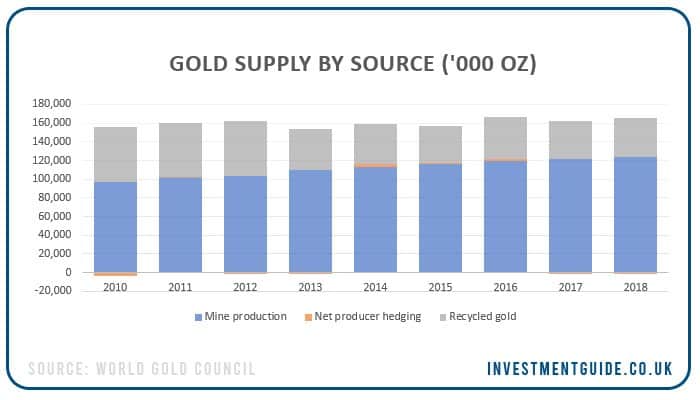

New gold mined in 2018 represents 75% of the total 2018 gold supply, with the remaining 25% relating to recycled gold. The recycled gold market is a thriving industry in its own right, with approximately 90% coming from jewellery, with the remaining 10% extracted from gold used in technology.

Gold supply vs. demand

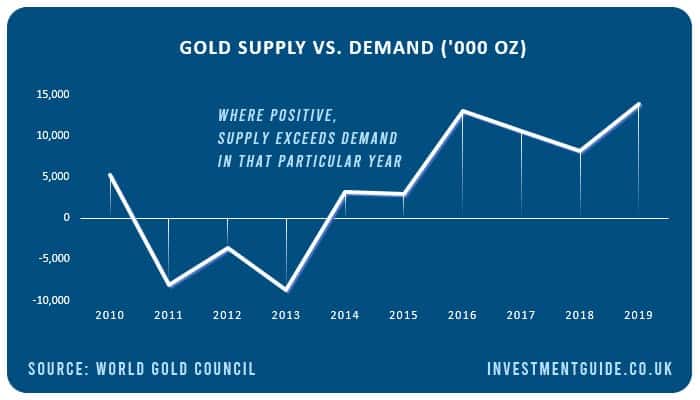

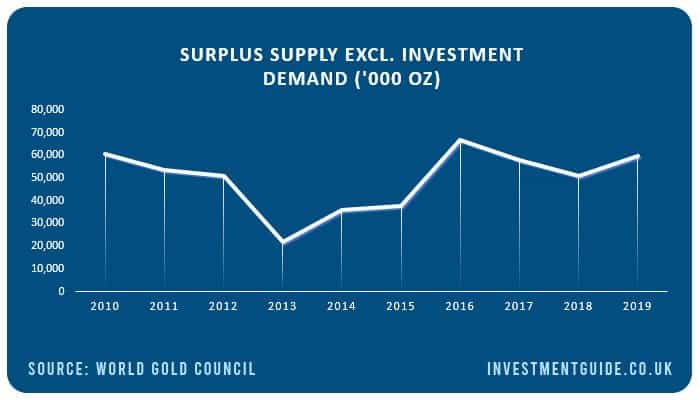

In the last six years, the level of gold supply has exceeded the level of demand. Excluding investment demand, the market balance is even more skewed towards oversupply. However, the gold price has taken no notice, increasing from $1,183.30 per oz on 31 December 2014 to $1,519.50 per oz on 31 December 2019.

Historical gold prices

Courtesy of Bullion Vault, see how the price of gold has fluctuated over time. We have set the chart to show price movements (per oz) over the last 5 years as default but data is available for the last 20 years.

{{CODEBullionVault}}

How to invest in gold

There are multiple options for investing in gold or gaining exposure to gold prices as part of your wider investment portfolio.

- Investing in physical gold

- Investing in gold mining companies

- Investing in gold ETFs

- Investing in gold ETCs

- Gold CFDs

Investing in physical gold

If you are looking to acquire physical gold as a private investor, the two most popular options available include buying directly from the Royal Mint or from Bullion Vault. Both options allow you to buy and store gold safely in secure storage facilities, though the Royal Mint also provides the additional option of storing your gold investment at home.

Royal Mint Bullion

Physical gold can be purchased directly from the Royal Mint which is owned by Her Majesty’s Treasury. The Royal Mint sells both gold bullion bars and limited release gold bullion coins for collectors. When you invest in gold through The Royal Mint, you acquire specific gold bullion bars or coins.

- Gold bullion bars – Available in 1g, 5g, 10g, 1oz (28.3g), 100g, 500g, 1kg, 400oz (11.34kg) weights.

- Gold bullion coins – Multiple limited edition gold bullion coins are available at any given time, in weights of 1/10 oz, 1/4 oz, 1/2 oz or 1 oz. These coins are sold at a slight premium to bullion bars of the equivalent weight.

When purchasing gold from the Royal Mint, you can opt to take physical possession of the gold to store at home or you can store it in ‘The Vault’ which is the Royal Mint’s purpose built previous metal storage facility. By storing with The Vault, you can be assured of the safety of your investment as the facility boasts state-of-the-art security systems and 24/7 on-site security. An annual fee of 1.0% (plus VAT) based on the value of the gold bullion you store is charged to use this facility.

Be aware that buying gold from the Royal Mint is not the most cost-efficient way of investing in gold. However, for investors who are concerned about security and have more faith ordering directly from the treasury, it is certainly an option to consider.

When it comes to selling your gold, you can either find a willing buyer on the open market or you can sell it back to the Royal Mint. However, be aware that if you do choose to sell it back to the Royal Mint in the short term, you are likely to make a loss as a wide spread is operated between buy and sell prices.

If you are buying multiple gold bullion bars/coins, bulk purchase discounts are available directly through the Royal Mint website.

Bullion Vault

Bullion Vault is the biggest online gold investment platform with over $2 billion in stored bullion.

Bullion Vault offers an alternative way to invest in gold bars. When buying through the Royal Mint, you have the option of taking physical ownership of bullion bars and coins varying in weight from 1g to 400oz (11.34kg). However, no such option exists with Bullion Vault as the platform solely enables fractional ownership of gold 400oz (11.34kg) ‘good delivery bars‘. These bullion bars would individually exceed the budgets of most private investors and are typically traded by miners, refiners, bullion banks, manufacturers and industrial users. By following this model and acquiring gold at wholesale weights and prices, Bullion Vault is able to offer lower pricing than the Royal Mint.

When investing in Bullion Vault, the fees to be aware of are commission fees and storage charges. Commission is payable when initially acquiring gold and is charged at 0.5% on the first $75,000 of purchases with lower fees if investing higher amounts. The same commission is charged when selling gold. However, the savings generated from buying via Bullion Vault will typically more than compensate for this fee.

In addition, storage fees can be far cheaper than the Royal Mint as only 0.12% per annum is charged for gold storage, though this is subject to a minimum charge of $4 per month. Gold is stored in secured vaults and benefits from insurance. Bullion Vault completes daily audits of its holdings, providing daily proof of ownership to investors.

Investing in gold mining companies

An alternative to directly investing in physical gold is to invest in gold mining companies whose fortunes are heavily influenced by the price of gold. By investing in gold mining companies rather than physical gold, you can potentially drive profits through both dividend payments and capital appreciation, whereas an investment in physical gold relies solely on generating a capital gain.

The largest listed gold mining companies are listed below. The majority of these are listed on the New York Stock Exchange. Only Polymetal International is listed on the London Stock Exchange, though note that this is not a pure gold-play as the company also mines a significant volume of silver.

| Company | Stock Exchange | Ticker Symbol |

|---|---|---|

| Newmont | New York | NEM |

| Barrick Gold | New York | GOLD |

| Polyus | Moscow | PLZL |

| Newcrest Mining | Australian | NCM |

| Yamana Gold | New York | AUY |

| Kinross Gold | New York | KGC |

| Polymetal International | London | POLY |

You can invest in gold mining companies like those listed above using the services of an execution-only platform such as Hargreaves Lansdown (to see a comparison of investment platforms, click here).

Investing in gold ETFs

As well as investing in individual gold mining companies, you can also invest in gold ETFs which track gold indices such as the NYSE Arca Gold Miners Index or the S&P Commodity Producers Gold Index, both of which attempt to track the overall performance of companies involved in the gold mining industry.

Example gold ETFs include:

| ETF | Symbol | Stock exchange | Index tracked | TER |

|---|---|---|---|---|

| iShares Gold Producers UCITS ETF | IAUP | London | S&P Commodity Producers Gold Index | 0.55% |

| VanEck Vectors Gold Miners ETF | GDX | New York | NYSE Arca Gold Miners Index | 0.52% |

Investing in gold ETCs

Gold ETCs either aim track the performance of the gold spot price (price for immediate supply) or future price (price for future supply).

Gold ETCs can track the performance of these prices through either holding physical gold in storage or holding derivatives such as swap agreements.

The below gold ETCs all track the spot price of gold and are backed by physical gold held in storage by a trustee:

| ETC name | Ticker symbol | Tracking | Replication method | Ongoing charge (total expense ratio) |

|---|---|---|---|---|

| iShares Physical Gold ETC | SGLN | Spot price | Physical | 0.19% |

| Invesco Physical Gold ETC | SGLD | Spot price | Physical | 0.19% |

| Royal Mint Physical Gold Securities ETC | RMAU | Spot price | Physical | 0.22% |

To invest in one of these gold ETCs, you can use an execution-only share trading platform such as Hargreaves Lansdown (to see a comparison of investment platforms, click here).

Gold CFDs – trading gold

Certainly not one for beginners, but an alternative way for experienced traders to gain exposure to the gold market is through trading CFDs on gold futures (symbol: XAU) via a trading platform such as Plus 500. CFDs are a leveraged trading product where you can take long or short positions, depending on whether you think the price of gold futures will rise or fall.