Kuflink is a UK-based peer to peer lender, which exclusively offers bridging/development loans secured against UK property (first or second charges). Prior to entering the peer to peer lending market in 2017, Kuflink’s sister company operated as a specialist bridging loan provider since 2011.

Over £100m has been invested on the platform since launch, with Kuflink boasting on its homepage that no lender has lost capital to date. However, as with all investments, historical success is no guarantee of future performance. Be sure to read our full Kuflink review to understand more about the type of underlying loans Kuflink offers and the key risks of investing.

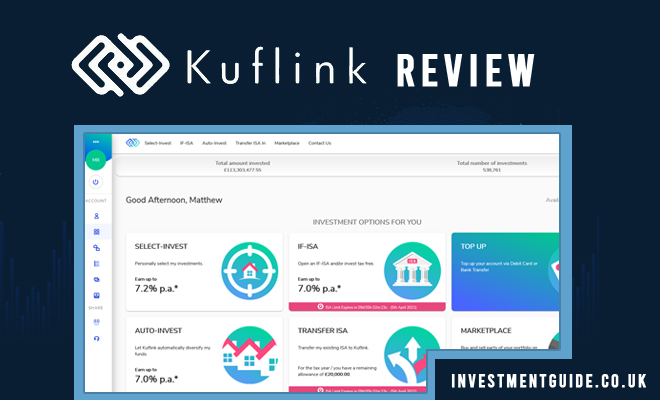

Investment options

The platform enables its investors to invest in individual property loans (Select-Invest) or in a basket of loans with investments automatically made by the platform on behalf of investors (Auto-Invest).

Kuflink also offers an Innovative Finance ISA, though it is only possible to invest in the Auto-Invest product through this wrapper.

Bridging loans

Kuflink specialises in the provision of bridging loans.

Bridging loans are short-term property loans often used to aid cash flow. They are commonly used by property developers as they are typically granted fairly quickly and with reduced lending requirements when compared to traditional bank mortgages. For example, a property might not qualify for a traditional mortgage from a bank prior to redevelopment works taking place.

Bridging loans are higher risk for lenders and thus a higher interest rate can be charged. The current average monthly interest rate on the Kuflink platform is 1.1%.

Lending criteria

Kuflink lends based on the following criteria:

- Lending terms – Ranging between 1 and 24 months.

- Property types – Commercial, semi-commercial, investment property, residential property, buy-to-let, auction, and land with or without planning permission. Freehold and long leasehold only. No short lease terms are accepted.

- Loan purpose – Loans are provided for business purposes only. For example, property development or renovation/refurbishment, acquisition of property/assets, business use and/or cash flow.

- Loan size – Loans of between £50,000 and £750,000 are typically provided. Requests in excess of this upper limit are considered on a case-by-case basis.

- Seniority of security– Kuflink accepts both first and second charges, with the vast majority being first charge.

- Maximum Loan-to-Value – 75%. Where valuations are requested by Kuflink, borrowers must pay and must provide a valuation dated within the last three months.

- Customers – Individuals or companies.

- Borrowers must provide Kuflink with evidence of how they intend to repay the debt at the end of the loan term.

Interest rates

For Select-Invest, interest rates typically vary between 6.7% and 7.2% per annum. You can choose whether to receive interest on a monthly basis or to compound your interest, receiving all interest at the end of the loan term.

Auto-Invest interest rates vary depending on the term selected (1, 3 or 5 years), with interest rates up to 7.0% for the 5 year term. With this product, interest compounds annually and is received at the end of the investment term selected. It is possible to opt out of this arrangement to receive interest on an annual basis.

Transparency

The platform is very open about the performance of its loan book, both in the past and present. Within the customer dashboard (which is visible post sign-up), it is possible to see all ‘available’, ‘live’ and ‘repaid’ loans.

Further, the company also reports detailed statistics on loan book performance such as:

- Average monthly interest rate

- Average LTV

- Geographical spread of loans

- Breakdown of type of property

- Historical lending volumes and values

- Average property value

- Default and write-off statistics

- Average additional months in loan term (common in bridging/development loans)

Skin in the game

One of Kuflink’s unique selling points is its ‘skin in the game’ policy. Kuflink co-invests in its own loans, taking up to a 5% holding in its Select-Invest loans. The amount invested can be clearly seen by clicking on the ‘loan details’ page within the customer dashboard.

Secondary market

A secondary market exists on the Kuflink platform. Subject to demand, this allows investors to exit their investments prior to the end of the loan term.

It is not possible to sell loans which are late, in arrears or in the first or last month of their loan term.

The secondary market does not allow discounting and is subject to a selling fee of 0.25% which is payable to Kuflink for facilitating the sale.

User experience

The Kuflink platform is easy to use and the company has recently launched an app (available on both iPhone and Android) through which you can manage your investments.

Key risks

The key risks of investing in Kuflink are no different to investing in any other peer to peer lending platform. If you are new to peer to peer lending, our peer to peer lending guide is a good place to start.

New customer sign-up offer

The platform commonly offers new customer sign-up offers to entice investment. At the moment, new customers investing via this link will receive cashback from Kuflink. The cashback payable varies based on how much is invested within the first 30 days from opening an account.

- £500 to £999.99 to get 2.0% cashback

- £1,000 to £4,999.99 to get 2.5% cashback

- £5,000 to £24,999.99 to get 3.0% cashback

- £25,000 to £49,999.99 to get 3.5% cashback

- £50,000 to £99,999 to get 3.75% cashback

- £100,000 to get 4.0% cashback