The ‘Locked Box’ completion mechanism is an increasingly popular closing mechanism for M&A transactions, particularly in Europe. In the US, the traditional ‘completion accounts’ process continues to reign supreme.

The same key deal economics apply to both completion mechanisms – the price is agreed on a cash-free, debt-free basis based on a ‘normal’ level of working capital in the business using the enterprise value to equity value bridge.

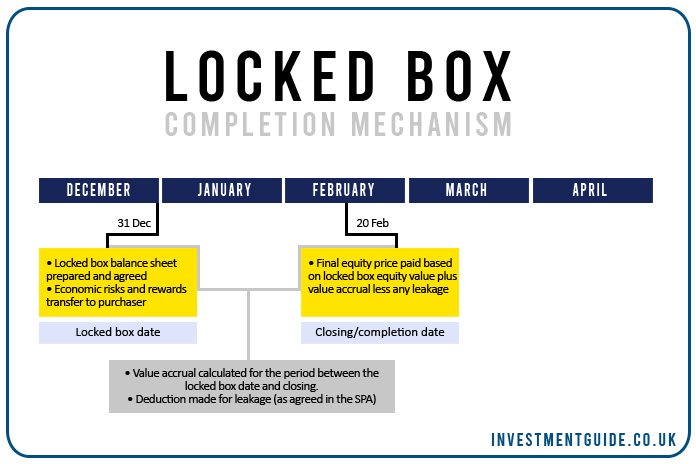

The key distinction is that using a locked box completion mechanism, the purchase price is fixed at the locked box date with a value accrual methodology and leakage provisions agreed upfront. This means that the buyer and seller both have certainty over the price paid/received at the completion date.

What is a locked box?

The term ‘locked box’ refers to the balance sheet at a specified date. The vendor will typically warrant the balance sheet for the business at this point in time prior to signing the share purchase agreement (‘SPA’). This locked box balance sheet is used to make the required net debt and net working capital equity adjustments to arrive at an agreed upon equity value. The equity value is then written into the SPA and paid by the purchaser at completion, with no further adjustments made.

Using this mechanism, the economic risks and rewards transfer to the acquirer from the locked box date. However, the vendors continue to run/manage the business between the locked box date and completion date. As such, further purchase price adjustments must be made in respect of a value accrual and leakage.

What is leakage?

Leakage refers to the extraction of value by the vendors or connected parties. Leakage can diminish the balance sheet value which if not adjusted for would result in the purchaser receiving less value than they have agree to pay.

A simple example would be the payment of a dividend between the locked box date and the completion date. If a purchaser agrees an equity value of £10m based on a locked box date of 31 December, this value will have been calculated on a debt-free, cash-free basis (i.e. cash/debt in the business is paid for, pound for pound). If prior to the completion date of 20 February, a dividend of £2m is paid to the existing shareholders, the business inherited on 20 February by the new acquirers would have £2m less cash than they paid for.

The SPA will define what constitutes ‘leakage’ (where the purchaser has recourse to the vendor) and ‘permittage leakage’ (covers leakage both parties are aware of, meaning the purchaser has no recourse to the vendor). The example of dividend payments cited above is commonly included as ‘leakage’, which would result in a negative purchase price reduction of £2m.

In addition to the dividend example cited, other examples of leakage include:

- Any transfer of value made to management/shareholders or connected persons

- Transaction related costs (e.g. advisor fees incurred by the vendor)

- Transaction bonuses payable to management/staff

- Waiver of balances owed by the sellers

- Payments made to other group companies which are not in the ordinary course of business

Examples of permitted leakage include:

- Any items agreed pre-exchange and/or factored into the purchase price paid (e.g. if a dividend was known and considered in the net debt adjustments)

- Payments made to other group companies which are in the ordinary course of business / on arms-length terms

- Payment of any normal course business costs (e.g. staff costs)

Where the vendor extracts value through means less overt than the simple dividend example cited above, the purchaser can require the vendor to reimburse them if further leakage is identified within a specified time frame post-transaction (typically varies between 3-18 months). However, the SPA needs to be thorough in this regard to ensure protection.

What is a value accrual?

A value accrual is a means of compensating the vendor for (i) running the business for the period between the locked box date (when the economic risks and rewards transfer) and the completion date, and (ii) having capital tied up until the completion date when the purchase consideration is paid. This is typically of particular importance to vendors who are operating profitable businesses as the profits generated post-locked box date will remain in the business.

The two most common approaches to calculating the value accrual are:

- Daily cash profits charge. A fairly common method for calculating the cash profits charge is profit after tax and interest (excluding depreciation and amortisation) less, in some cases, capital expenditure. However, this is commonly negotiated as there is no general consensus on the appropriate methodology. As management accounts will typically not be available for the period between the locked box and completion date at the date of completion, this adjustment is typically calculated using a combination of actual results and forecast results.

- Interest applied to the equity value agreed. The interest rate applied is negotiated between buyer and seller and most commonly reflects an equity-return based rate, as opposed to a debt-return based rate.

When is a locked box suitable?

A locked box mechanism is most appropriate for fairly simple acquisitions. For example: a company which has a single set of shares, stands alone from an operational standpoint and has discrete accounting systems.

The locked box mechanism becomes far more complex if the business being acquired does not stand alone from other operations of the vendor from an operational or accounting perspective. This is because it becomes difficult to consider any potential leakage between the locked box and completion dates. Therefore, ideally there should be as few transactions as possible between the business being acquired and the vendor group post the locked box date.

The vendor must be able to satisfy the purchaser that the ‘box’ can be effectively ‘locked’ so that value does not leak out between the locked box date and completion.

In carve-out situations where a pro-forma balance sheet has to be prepared, the completion accounts mechanism is likely to be deemed most appropriate.

What date is typically used for the ‘locked box’?

Theoretically, any date could be chosen. In practice, however, the locked box date almost always falls on a month-end because management accounts are routinely prepared on a monthly basis. In an ideal world, the locked box date chosen would be an audited balance sheet.

If the locked date balance sheet is not audited, the acquirer needs to get comfortable that the locked box balance sheet can be relied upon. Questions will be asked of Management regarding whether they account differently at month-end vs. year-end and consideration will be given to the quantum and value of audit adjustments applied historically. It is worth noting that even if the locked box balance sheet is audited, the acquirer should be aware that the accuracy of the balance sheet will be subject to audit materiality thresholds.

Advantages and disadvantages of using a locked box completion mechanism

From a sellers perspective

Advantages of locked box

- Price is fixed at completion, providing certainty.

- Increased control over the sales process.

- Less ambiguity – no time investment required debating completion accounts.

- Lower cost as professional advisors not required to return for completion accounts process.

Disadvantages of locked box

- May not be fully compensated through the value accrual for running the business for the period between the locked box date and completion.

- Requires a strong finance function and confidence in the vendors ability to produce reliable locked box accounts.

From a purchasers perspective

Advantages of locked box

- The buyer similarly benefits from pricing certainty.

- Reduced time debating completion accounts adjustments.

- Reduced cost associated with hiring professional advisors to review completion accounts.

- Simple transaction structure.

- Allows the business to move on and focus on running the business post-completion.

Disadvantages of locked box

- Requires an increased amount of due diligence on the locked box balance sheet as there is no completion accounts process to fall back on.

- Increased reliance on warranties to gain comfort over the locked box balance sheet.

- Net debt and net working capital adjustments are negotiated prior to taking control of the business, meaning the seller has a higher level of knowledge of the items being debated.

- Risk of business deterioration between the locked box date and completion date.

What are completion accounts?

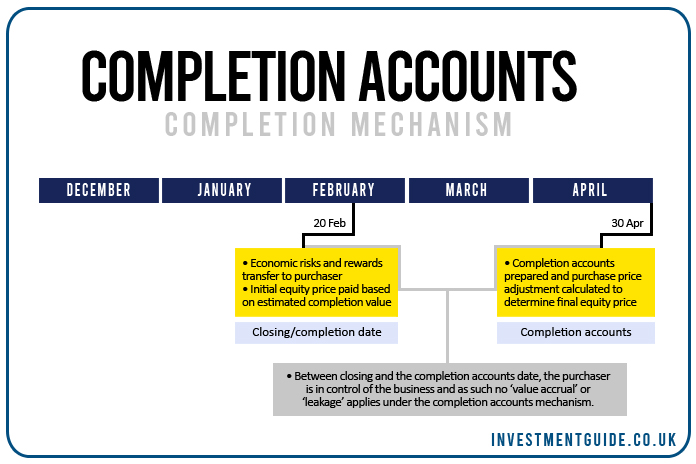

The alternative to a locked box completion mechanism is the traditional completion accounts mechanism where the purchase price is not fully known at the completion date. At completion date, final equity value adjustments are applied based on the actual balance sheet of the business being acquired at close of business on the date of completion. An initial price is paid based on this calculation, but this price is subject to change based on the drawing up of completion accounts at an agreed upon later date (typically up to 90 days post completion).

Under a locked box mechanism, the seller has control over the business until the completion date. The purchaser needs to elicit as much information as possible about the locked box balance sheet in order to propose net debt and net working capital equity value adjustments.

That dynamic is reversed with completion accounts as the purchaser takes control of the business from the completion date. This means that at the point that completion accounts are prepared, the purchaser is the party with control over the financial information of the business. This means that the seller becomes the party which has to diligence and determine the accuracy of the proposed completion accounts adjustments.

When are completion accounts suitable?

Whilst the completion accounts mechanism can be used on any transaction, it has clear advantages over the locked box mechanism in complex situations. For example, in acquisitions where part of a larger business is being acquired (known as a ‘carve-out’) and there is significant intra-group trading.

Advantages and disadvantages of using a locked box completion mechanism

From a sellers perspective

Advantages of completion accounts

- The transaction process may be sped up as the buyer may require less comfort on the balance sheet prior to completion (as there will be a completion accounts adjustment months later).

- The seller receives the benefit of profits up until the completion date without having to rely on a value accrual.

Disadvantages of completion accounts

- Potential for dispute in the completion accounts process and additional associated costs – the seller will not be in control of the business at this point in time and so will have less visibility and control over the adjustment process.

- Potential for purchaser to attempt to price chip – where there are disputes, these can be passed onto an independent expert.

- Economic risk remains with the seller until the point of completion (whereas under locked box, it passes to the buyer from the locked box date).

- Uncertainty over final purchase price until the completion accounts process is finalised.

- Costs associated (e.g. professional advisor fees) with reviewing the completion accounts.

From a purchasers perspective

Advantages of completion accounts

- Ability to check the completion accounts when in full control of the business, with complete access to the financial information.

- Ability to adjust the purchase price post-transaction through the completion accounts mechanism. For example, the business may have under-accrued for a particular liability at the completion date, which is recognised when the completion accounts are drawn up.

Disadvantages of completion accounts

- Potential for dispute and additional associated costs.

- Costs associated (e.g. professional advisor fees) with reviewing the completion accounts.

- Uncertainty with regards to the final purchase price.