A CFD is a ‘contract for difference’. It is a leveraged derivative product which allows you to speculate on the price movements of securities (e.g. shares, indexes, forex, commodities) without ever owning the underlying asset.

Using CFDs, it is possible to generate a profit not only when securities rise in value, but also when they fall.

If you think a security will increase in value, you ‘buy’ (also known as ‘going long’). If you think the security will decrease in value, you ‘sell’ (also known as ‘going short’).

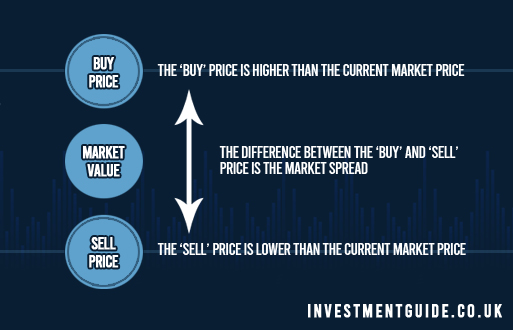

The buy price exceeds the current market value, whereas the sell price is less than the current market value. The difference between the two is the ‘spread’.

The ‘spread’ is how the market makers (i.e. the stockbroker facilitating the CFD contract) makes its money. The market maker profits from this spread irrespective of whether you make or lose money.

If the market moves in the direction you predict, you profit. For example, if you ‘go long’ and the share price rises above your buy price, or you ‘go short’ and the share price falls below your sell price.

Conversely, if the market moves against you, you will lose money. For example, if you ‘go long’ and the share price falls below your buy price, or you ‘go short’ and the share price rises above your sell price.

How do CFDs work? Worked example of a CFD buy order

When you enter into a CFD, you are acquiring a contract for the price movement on a set number of securities.

For example, if you bought a CFD for 10,000 shares in BP when the buy price was £3, and closed with a sell price rose to £3.10 (a 3.33% increase), you would generate £1,000 profit (£0.1*10,000).

If you were just buying BP shares, to get exposure to the price movement of 10,000 shares, you would need to purchase them at £30,000 (10,000 * £3). However, CFDs are a leveraged product which means that you can trade with a small deposit (‘margin’). For example, Trading 212 offers 5% margin on FTSE 100 CFDs. This means that if you wanted to buy a CFD for 10,000 BP shares, you would only need to deposit £1,500 (£3 * 10,000 * 5%).

This leverage significantly increases the potential profit opportunity but also the risk to traders as it is possible to lose more than you originally deposit.

Using the above example, if you had taken that bought a CFD for 10,000 BP shares, you would have initially required a deposit of £1,500 and would ultimately profit £1,000 when the position was closed.

However, lets imagine the sell price falls to £2.85 (5% decrease). If you closed your position at this point, you would lose the full £1,500 deposit (10,000 * £0.15). If the sell price fell further to £2.80, you would actually be down £2,000 (10,000 * £0.2), meaning that you would lose £500 more than the initial deposit you made.

For this reason, it is important to manage your risks through the use of ‘stop’ and ‘limit’ orders (read more about types of orders).

Trading CFDs vs. buying shares

We have already discussed that leverage (and the opportunities and risks that it brings) is the key difference between trading CFDs and buying shares. However, there are some other differences that you should be aware of:

- If you purchase shares in the UK, you need to pay stamp duty on that purchase. However, as CFDs are derivative products, no stamp duty is payable when trading.

- When you purchase a share, you own that security and pay the market price to acquire it in full. However, when you trade CFDs, you trade on margin. If you wish to keep your position open overnight, there is a financing cost associated. On Trading 212, the financing cost varies depending on the instrument you are trading (and also whether you are long or short on that instrument). The fees are then calculated by taking the quantity of CFDs * swap rate * number of nights. These fees are generally not significant in the context of the CFD exposure, however, you should be aware of this cost prior to trading.

- At the point of buying a CFD, you are immediately in a loss-making position due to the market spread (i.e. the sell price is lower than the buy price you have agreed). This means that it is not possible to back out of your position without incurring a loss unless the sell price moves above the buy price.

How to trade CFDs in the UK

The most popular UK-based CFD platform is Trading 212. Trading 212 allows you to trade CFDs on shares, forex, indices and commodities in all the main markets with zero commission and tight spreads. Other CFD platforms include Plus500 and IG.

Note that beginners should not jump into trading CFDs lightly – they are an advanced trading tool typically reserved for experienced traders. Before you invest real money, be sure to open a ‘virtual money’ account first.