Financial due diligence (‘FDD’) is a review of a Target company’s financial information prior to a proposed transaction. FDD is often used to support deal rationale, confirm that the purchase price agreed for the Target remains appropriate, and to identify the appropriate enterprise to equity value adjustments for the share purchase agreement.

In this article, we focus on the type of financial due diligence performed during an acquisition of a private business in the UK.

Such FDD work is commonly conducted by ‘Transaction Services’ (also known as ‘Transaction Diligence’) teams within accountancy firms such as the Big 4 (EY, PwC, KPMG and Deloitte). A financial due diligence team will typically comprise a core FDD team as well as a tax workstream to consider potential tax risks and exposures, and potentially to advise on the structuring of the deal.

Other common due diligence workstreams, which are not considered in this article, include commercial due diligence, legal due diligence, HR due diligence, IT and cyber due diligence and operational/supply chain due diligence.

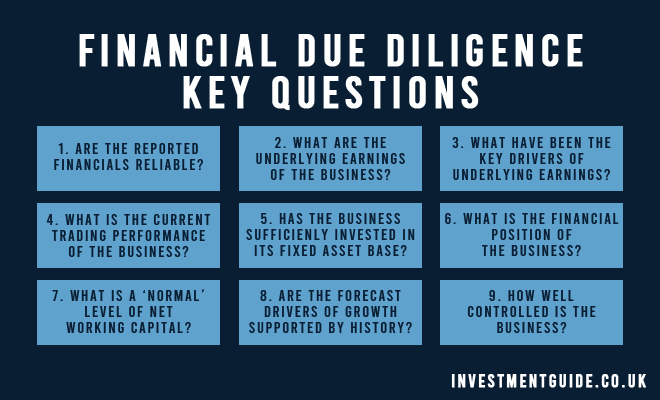

Prior to commencing an FDD engagement, an FDD team agrees a tailored scope of work based on the client’s key concerns and requirements. Whilst the scope of work is tailored, there are several key questions that FDD will typically attempt to address (see below).

Key Financial Due Diligence questions

Are the reported financials reliable?

- Can the reported financials be reconciled back to the audited financial statements?

- Were the audited financial statements unqualified (i.e. free from material misstatement)?

- Has information provided (e.g. revenue data, balance sheet breakdowns) been easy to reconcile back to management accounts/statutory accounts?

What are the underlying earnings of the business?

- Are there any one-off items which need to be stripped out to arrive at an Adjusted EBITDA?

- Any related party transactions not conducted at an arms-length basis?

- Are any pro-forma adjustments required (e.g. where the Target has made acquisitions or undergone restructuring programs across the historical period)

- Does a constant currency adjustment need to be considered, where foreign exchange rate movements significantly impact trading results?

- Are there any standalone cost considerations? For example, where a business is being carved-out from a larger business.

What have been the key drivers of historical earnings?

- What are the drivers of revenue growth (volume vs. sales price)?

- Are there any themes emerging when discussing customer by customer revenue trends (e.g. common reasons for churn)?

- Which parts of the business are growing and why?

- What factors have impacted gross profit margin (sales price, cost, mix)?

- What has driven EBITDA margin improvement – has the business leveraged its operating cost base?

- What proportion of costs are fixed vs. variable?

What is the current trading performance of the business?

- How does the current trading performance compare to the original budget for the year?

- Does current trading support the forecast outturn?

- What is the current ‘run rate’ of the business?

- Are the business’ tax controls sufficient?

Has the business sufficiently invested in its fixed asset base?

- Has the business under-invested in capex in recent times due to the upcoming sales process?

- Are IT systems fit for purpose or might improvements/investment be required post-transaction?

What is the financial position of the business?

- In addition to reported net cash/(debt), are there any potential debt-like items to consider (e.g. off balance sheet liabilities)?

- Are assets materially overstated or liabilities materially understated? For example:

- Any recoverability risk around aged debtor balances?

- Any ongoing legal cases where the potential liability is under-accrued?

- Any risk of stock write-offs due to aged or slow-moving inventory?

- Has accrued income (and therefore revenue) been inappropriately recognised and is there a risk regarding recoverability of those items not yet invoiced?

- Does the business have any potential tax liabilities which are currently not recognised on the balance sheet?

- Are any warranties or indemnities required in the SPA in relation to specific risks identified?

What is a ‘normal’ level of working capital?

- What are the working capital / cash flow characteristics of the business

- Have one-off, non-trading and items no longer representative of the net working capital profile going forward been excluded from ‘normal’ working capital?

- Are there any items within working capital that could be argued as being more ‘debt-like’ in nature?

- Does the share purchase agreement reflect the accounting policies utilised?

Is the forecast plan supported by historical evidence and what are the drivers of future growth?

- What proportion of forecast revenue is supported by contractual revenues?

- Of any remaining gap, what pipeline or order book support is available?

- What are the key risks and sensitivities?

- Which areas of the plan have potential upside vs. what Management has assumed?

- Does the business have sufficient capacity to support future growth?

- How achievable is the forecast plan?

- What assumptions are underpinning the assumed EBITDA growth?

- What margin improvements/cost savings have been assumed and are they feasible?

- What level of staff has the business assumed will be required?

How well controlled is the business?

- Does the business track the typical key performance indicators that would be expected in the sector?

- Does the finance team appear capable based on information quality and Q&A interactions?

- Was data required readily available or might the acquirer wish to consider investing in making systems improvements?

- What reconciliations does the business perform on a regular basis?

- How many adjusted/unadjusted audit adjustments are identified each year?

- If the business is a carve-out from existing operations, how separate have the businesses been run previously and can trading results be relied upon or are they skewed by intercompany trading?