BRRRR is an acronym which stands for Buy, Renovate, Rent, Refinance and Repeat. It’s a legitimate property investment technique which aims to (i) maximise investment returns through buying a property requiring improvement, and (ii) minimise the amount of cash tied up in the deal in order to move onto the next property investment opportunity.

How does BRRRR work?

There are five stages to the BRRRR strategy, as follows:

Buy – Acquiring the right property

When using the BRRRR method, success will be dependent upon finding the right property in the right location. The most important considerations are (i) the potential end value of the property post renovations, and (ii) the attractiveness of the local rental market.

Remember that the price you pay for the property is important. In order to maximise the end value of the property, or rather, to maximise the value increase of the property, you should aim to secure deals at attractive valuations.

Renovate – Add value to the property through making appropriate renovations

In order to add value through renovations, you may opt to simply reconfigure or redesign the existing space (for example, turning a 3 bed property into a 4 bed property, or simply modernising the house and it’s interior design), or more extensive building extension work may be required.

Prior to purchasing the property and undertaking the renovation project, you should have a strong idea of what it is you are trying to achieve, how much that is likely to cost and how much value those changes are likely to add to the property.

Rent – Find a suitable tenant and maximise rental yield

In order to support a higher property valuation, it’s important to maximise the rental yield on the property. This is an important step in evidencing the value you have added to the property.

One tactic to maximise rent often employed by landlords utilising the BRRRR method is letting the property to multiple unrelated tenants (HMO – House of Multiple Occupation). However, if the property is not already a HMO, planning permission may be required from the local council for the change in use. This is not always the case though as it depends upon whether your local council has introduced ‘Article 4’ directions.

Refinance – Refinance the debt finance to extract your built up equity

At this stage, you are looking for a lender who is willing to refinance your existing financing at the new higher property valuation.

In the UK, buy to let property mortgages typically require a 25% deposit, so you will require a lender which is willing to lend 75% of the new higher property value.

When seeking new financing, the new potential lender will send a surveyor to assess the value of your property (with you typically funding the cost of this visit).

The surveyor will know the price you paid for the property from land registry records. He or she will be considering what evidence there is available to support the upwards valuation being sought.

A key method used by surveyors to ascertain value is comparing to similar sold properties in the local market.

Whilst there may be supporting external evidence for a valuation increase, such as property value growth in the local area, this is unlikely to be fully supportive of the increase in valuation you are seeking. This is why maximising rental yield is so important in supporting value. All other changes made should be well documented to further support the case. This is also important as the surveyor will not be aware of what was done before/after your acquisition where planning permission was not required.

Repeat – Find a new suitable property to start the process all over again.

Once you have refinanced and extracted your cash from the deal, you will be able to roll over your free cash into equity in a new deal.

How does this actually work?

BRRRR example with numbers UK

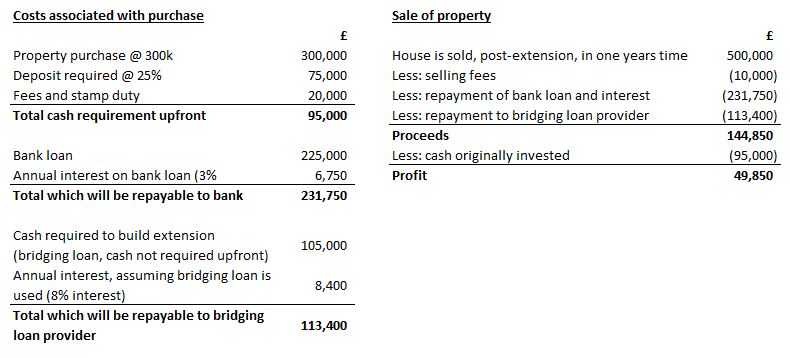

Original 3 bedroom property is purchased for £300k, for which a 25% deposit was required (£75,000). Fees and stamp duty of £20,000 were also payable which we will assume are paid in cash. Our total cash requirement to initially buy the property is therefore £95,000. Our total bank loan is £225,000.

Once we own the property, we need to fund the refurbishment to create value. Let’s assume we are building an extension which is costing £105k. We will need to finance this, either using our own cash or a bridging loan. Using a bridging loan is more common.

Our total cash outlay at this point is £95k. After the building works are completed, the house is re-valued at £500k. At this point, if we sell for £500k, repay the bank and bridging loan provider with interest, and pay the relevant selling fees, we would have achieved a profit of £49,850.