There are certain speculative bonds (also known as high yield or junk bonds) which are often referred to as fallen angels or rising stars. If you’ve heard these terms and not been sure what they are, then this is the article for you.

What are fallen angels?

Fallen angels are simply bonds which were previously classified as investment grade, but have been downgraded to become speculative grade. Fallen angel bonds are typically downgraded to a BB rating which Moody’s describes as having substantial credit risk.

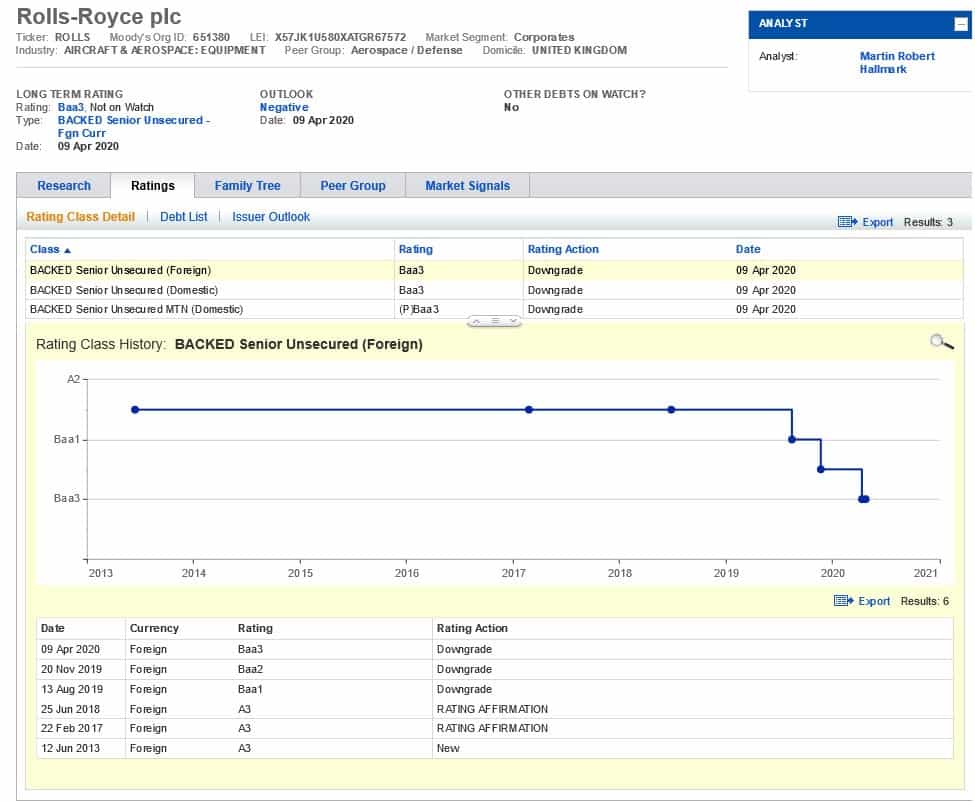

Companies with current ratings of Baa3 are most at risk of becoming ‘fallen angels’ as this is the lowest level of ‘investment grade’ bond. For example, the below Rolls Royce senior unsecured bond was previously rated A3 but slipped to a Baa3 rating with a negative outlook on 9 April 2020 following concerns about cash constraints driven by Coronavirus. This rating is still considered ‘investment grade’ but if the rating slips further, it will fall into the speculative grades and become known as a fallen angel.

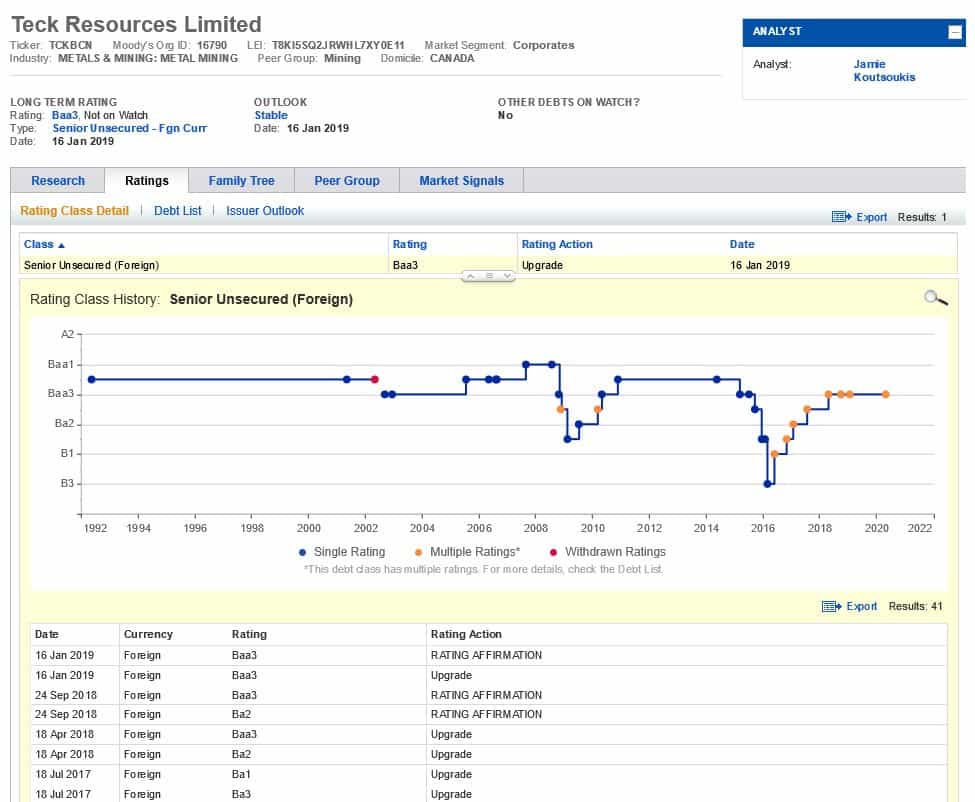

Fallen angels are not destined to remain speculative grade forever. For example, Teck Resources Limited, a Canadian domiciled metal mining company was a fallen angel in the past but improved its prospects to return to the investment grades. At its lowest point in February 2016, the bond was rated B3, but multiple ratings improvements have seen the bond regain an investment grade Baa3 rating.

What are rising stars?

A ‘rising star’ bond is a speculative grade bond that was launched as such but which features improving credit ratings which bring it closer to becoming an investment-grade bond. Rising star bonds remain speculative grade for now but are deemed to have a chance of becoming investment grade in the future.

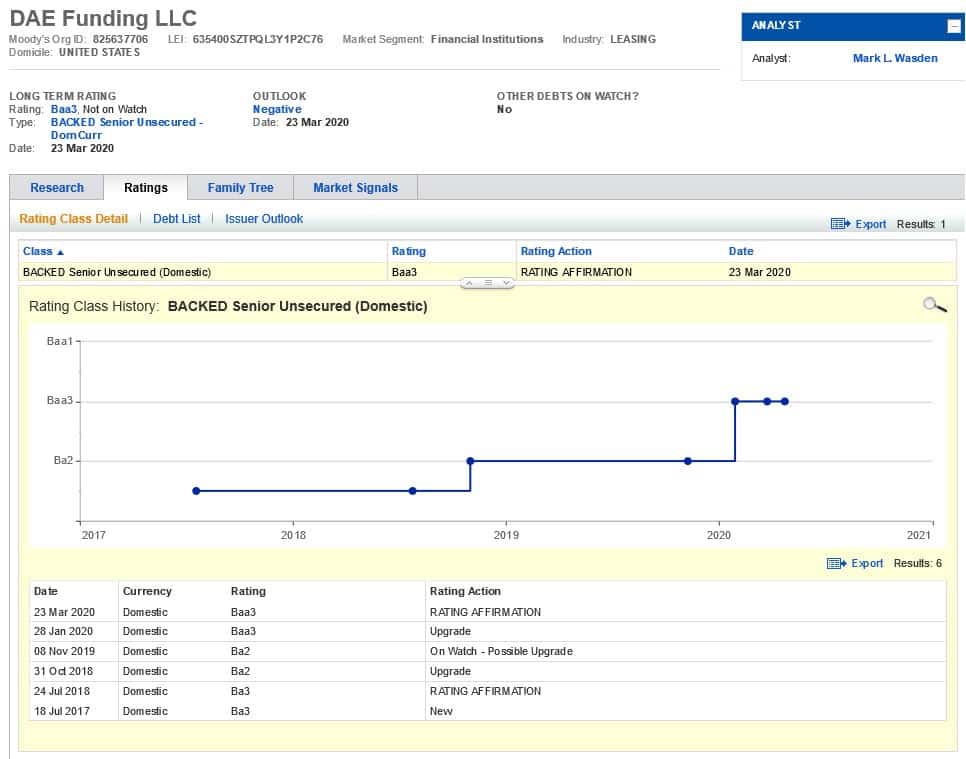

For example, this DAE Funding LLC bond would have been considered a rising star as it rose through the speculative grades from Ba3 to Ba2, before it became an investment grade bond rated Baa3 in March 2020.

List of bond ratings

See the below table for a full list of comparative bond ratings from Moody’s, Standard and Poor’s and Fitch.

| Grade | Moody's description | Moody's | S&P | Fitch |

|---|---|---|---|---|

| Investment grade | Highest quality, lowest credit risk | Aaa | AAA | AAA |

| High quality, very low credit risk | Aa1 | AA+ | AA+ | |

| Aa2 | AA | AA | ||

| Aa3 | AA- | AA- | ||

| Upper-medium grade, low credit risk | A1 | A+ | A+ | |

| A2 | A | A | ||

| A3 | A- | A- | ||

| Medium grade, moderate credit risk with some speculative characteristics | Baa1 | BBB+ | BBB+ | |

| Baa2 | BBB | BBB | ||

| Baa3 | BBB- | BBB- | ||

| Speculative grade (high yield / junk bonds) | Speculative, substantial credit risk | Ba1 | BB+ | BB+ |

| Ba2 | BB | BB | ||

| Ba3 | BB- | BB- | ||

| Speculative, high credit risk | B1 | B+ | B+ | |

| B2 | B | B | ||

| B3 | B- | B- | ||

| Speculative, very high credit risk | Caa1 | CCC+ | CCC | |

| Caa2 | CCC | CC | ||

| Caa2 | CCC- | C | ||

| Highly speculative, likely to be in, or very near, default. Some prospect of recovery of principal and interest. | Ca | R | DDD | |

| Typically in default, with little prospect for recovery of principal or interest. | C | SD | DD | |

| In default on all long-term debt obligations | D | D |

Learn more about fixed income investments in our comprehensive fixed income investment guide.