Investing in emerging markets has often been touted as one of the most effective ways to unlock high returns. With economies in regions such as Southeast Asia, Latin America, and Africa continuing to grow at a faster pace than their developed counterparts, these markets present significant opportunities for investors seeking diversification.

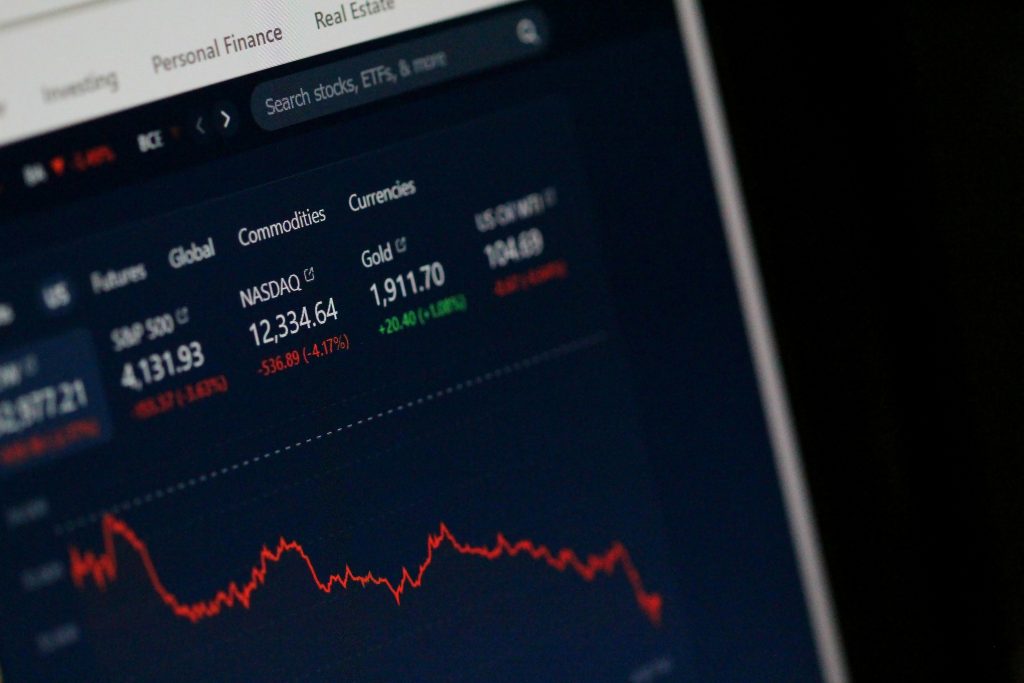

However. the volatility of emerging markets, coupled with political uncertainty and currency fluctuations, means that investors must tread carefully.

Identifying Growth Opportunities in Emerging Markets

Emerging markets, by definition, are economies in transition. These are nations moving from low-income to middle-income status, with industries and infrastructure rapidly evolving to meet the needs of growing populations. Economies such as China, India, Brazil, and South Africa have already made significant strides, and while they may not grow as rapidly as they once did, they remain critical players in the global economy.

Many emerging economies have youthful populations and increasing urbanisation, which drives demand for goods, services, and infrastructure. The rise of the middle class in these nations represents a growing consumer base, with more disposable income and a growing appetite for products ranging from consumer electronics to automobiles and healthcare. These trends present a variety of growth opportunities, particularly in sectors such as technology, healthcare, financial services, and renewable energy.

Countries like Vietnam, Indonesia, and Nigeria are prime examples of markets where industrialisation is fuelling economic growth. Vietnam is also an attractive business destination for foreign entrepreneurs who come to open different types of businesses here. The rise of digital economies in regions such as Southeast Asia and Africa also offers investors access to the next wave of tech innovators. E-commerce, digital payments, and telecommunications are thriving, making technology one of the most promising sectors.

Identifying the right opportunities can be challenging. Investors need to be mindful of the different stages of development and market structures within individual countries. For example, while China’s stock markets may be more accessible to international investors, other countries may still have less mature financial infrastructure.

The Impact of Political Risk in Emerging Markets

One of the most significant risks associated with emerging markets is political instability. Unlike developed markets, where legal frameworks and political systems are relatively stable, emerging markets are often characterised by shifting political landscapes. This can result in sudden changes to economic policies, taxation, or regulations, which may affect market conditions or the profitability of investments.

Argentina and Turkey have experienced periods of political and economic turmoil in recent years. In these cases, policy changes led to sharp currency devaluations and rising inflation, both of which severely impacted investor returns. Similarly, in South Africa, political infighting and corruption scandals have spooked many investors.

Geopolitical risks such as trade wars or regional conflicts can directly affect market sentiment and cause capital outflows. The US-China trade war, for example, created waves of uncertainty not just in those two countries but across emerging markets globally. Investors must remain aware that even the hint of political instability can lead to sharp declines in the value of assets.

Mitigating political risk requires thorough research and a well-diversified portfolio. Investing in a mix of countries rather than concentrating all assets in one or two markets is a common strategy to manage this risk.

Currency Considerations

Currency volatility is another key factor when investing in emerging markets. Unlike developed economies with relatively stable currencies, many emerging markets experience regular and sometimes extreme fluctuations in the value of their currencies. This can have a direct impact on investment returns.

If an investor buys shares in a company in Brazil and the Brazilian real subsequently depreciates against the British pound, any gains in the local stock price may be offset, or even wiped out, by the currency loss. Currency risk can also exacerbate losses during market downturns, particularly if a market’s currency weakens simultaneously with a fall in asset prices.

Additionally, inflation can erode the purchasing power of local currencies, adding another layer of complexity. Nations like Venezuela and Zimbabwe have experienced hyperinflation, causing the value of their currencies to plummet. While these may be extreme examples, inflation is a more common risk in emerging markets, and investors need to factor it into their decision-making process.

To mitigate risk, some investors turn to currency hedged exchange-traded funds (ETFs) or derivatives. However, these strategies can be costly and may not always be effective in periods of extreme volatility. It’s important to assess both the economic and political environment before committing significant funds.

The Role of Emerging Market ETFs

For many investors, emerging market exchange-traded funds (ETFs) have become a popular way to gain exposure to these high-growth regions. Emerging market ETFs provide a way to invest in a basket of stocks from multiple countries, offering diversification and reduced risk compared to investing in individual companies or markets.

ETFs are particularly attractive because they simplify access to otherwise difficult-to-reach markets. For example, accessing equities in countries like Nigeria or Colombia can be challenging due to the lack of market liquidity or infrastructure. However, with ETFs, investors can gain exposure to these regions without navigating local brokerage systems or regulatory hurdles.

ETFs also help spread risk across various sectors and regions, offering a broader range of opportunities than investing directly in a single emerging market. Major ETFs like the iShares MSCI Emerging Markets ETF or Vanguard FTSE Emerging Markets ETF track indices that include countries from across Asia, Latin America, Africa, and Eastern Europe.

That said, ETFs are not without their drawbacks. While they offer diversification, they may also expose investors to underperforming sectors or regions within the broader market. Furthermore, ETFs may not protect against currency fluctuations or political risks, and their performance can be heavily impacted by these factors. Therefore, while ETFs are a valuable tool for gaining exposure to emerging markets, they should be used as part of a broader investment strategy.

Balancing Risks and Rewards

Emerging markets offer a tantalising blend of high growth potential and equally significant risks. With youthful populations, rapidly expanding middle classes, and technological innovation driving economic development, the potential rewards for investors can be considerable. However, political instability, currency volatility, and the unique risks associated with each market require a cautious and diversified approach.

For those willing to navigate these challenges, emerging markets present a critical opportunity to diversify away from the slower growth rates seen in developed economies. But as with all investments, the key lies in balancing the risks against the rewards, doing thorough research, and maintaining a diversified portfolio that can withstand the inevitable fluctuations in these dynamic and unpredictable markets.