Silver prices have fluctuated considerably over the last 20 years. From the start of 2004 to 27 March 2011, investing in silver would have bagged you an impressive return of over 800% with silver prices rising from £110 per kg to £906 per kg. However, the market has since retracted significantly with silver reaching a low of £300 per kg in December 2015 before rallying to £390 per kg at the time of writing in April 2020.

Silver is far cheaper than other precious metals such as gold or platinum, which are currently priced at £44,000 and £22,240 per kg respectively in April 2020. Similar to both metals, silver is commonly used as a material for jewellery. However, a higher proportion of silver demand is driven by industrial use.

Carry on reading to understand what gives silver its value, where its mined, and how recent supply and demand trends have impacted silver prices. Finally, we will summarise the various ways you can invest to gain exposure to the silver market.

- What is silver used for?

- Where is silver mined?

- Silver supply vs. demand

- Historical silver prices

- How to invest in silver

What is silver used for?

In the past, a large proportion of silver demand was driven by luxury goods such as jewelry and fine art, similar to gold. Whilst that demand certainly still exists, a much greater proportion of silver demand is now driven by industrial applications.

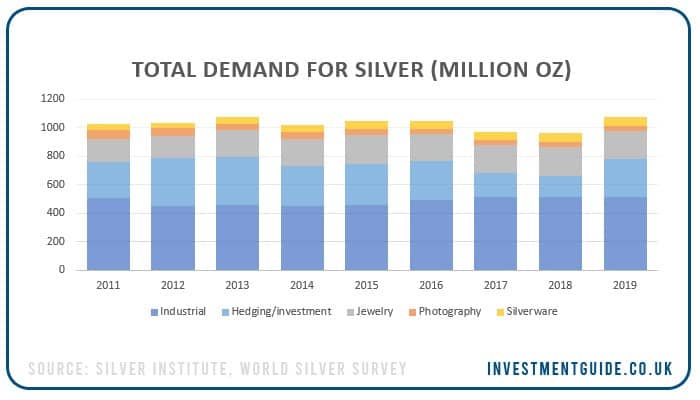

In 2019, the demand for silver was primarily driven by industrial use (47.6% in 2019), investment (24.9% in 2019) and jewelry (18.8% in 2019).

Silver in Industry

Electronics

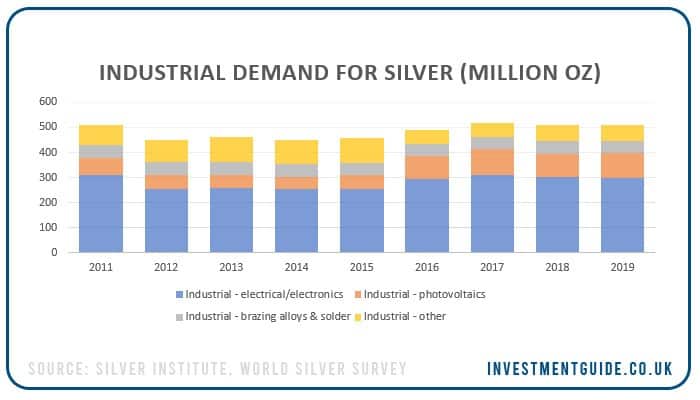

Silver can be found in virtually all electronic devices because of its strong thermal and electrical conductivity. Unsurprisingly then, silver use in electronics is the largest component of industrial demand.

If you were unaware of this fact, take a step back to consider how important silver actually is to your day to day life. Do you drive to work? Use a smartphone? Turn on light switches? All of these devices contain silver components which enable them to function.

Photovoltaics

Silver is used to produce photovoltaic cells which are then used to produce electricity. Silver is perfect for this use due to its excellent electrical conductivity. A silver power is transformed into a paste and loaded onto a silicon wafer. When light shines on the silicon, silver carries the electricity for immediate use or for storage in batteries for later consumption.

Brazing alloys and solder

Silver is commonly used in both brazing (joining materials at over 600 degrees Celcius) and soldering (joining materials at less than 600 degrees Celcius) metal pieces. Adding silver improves the strength of connections, makes them smoother, more leafproof, electrically conducive and corrosion resistant. Further, silver is seen as a popular substitution for soldering with the traditional mix of tin/lead which is known to produce hazardous dust/fumes.

Industrial – other

Silver also has several other industrial uses including but not limited to acting as a catalyst in the production of industrial chemicals and use in medicine (e.g. to coat medical devices to prevent infections).

Silver as an investment

Investment demand is split between physical investment in silver bars and coins and investment in silver exchange traded products. See the ‘investing i

Silver in jewellery and silverware

Silver is a popular choice for jewelry makers due to its price, malleability, reflectivity and shine. Whereas the best quality gold jewelry (24 carat) is available pure, the best quality silver jewelry (sterling silver) must be alloyed because it is so soft. Copper is the most common base metal used as an alloy, with sterling silver typically comprising 92.5% pure silver and 7.5% copper. This is because copper does not affect the colour of pure silver.

Silver is an attractive metal and far less expensive than gold, making it an extremely popular choice for consumers. Whilst silver is cheap relative to gold and platinum, the price of silver jewelry can fluctuate significantly based on the amount of labour required, skill of the jewelry maker and the intricacy of the design.

The same characteristics that make silver suitable for the creation of jewelry also apply to silverware. Whilst it is possible for silver to tarnish, the application of polish with a soft cloth can quickly restore the level of shine. This is why antique silverware commonly looks much newer than it actually is.

Silver in photography

Traditional cameras which used film relied on the photo sensitivity of silver halide crystals. However, the rapid growth in digital photography has caused the demand for silver in photography to more than halve in the last ten years.

Where is silver mined?

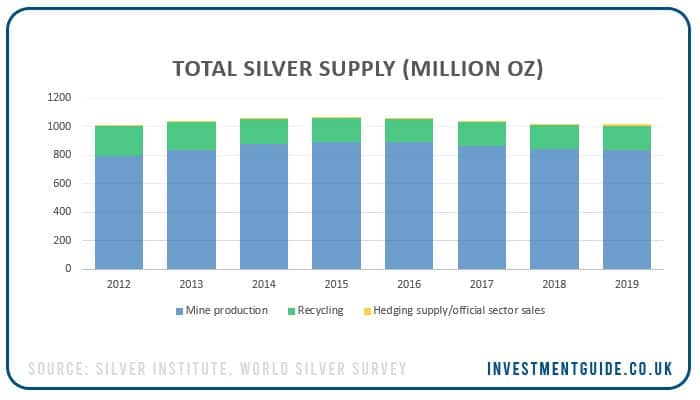

The majority of the annual silver supply is derived from silver mine production (80.4% in 2019).

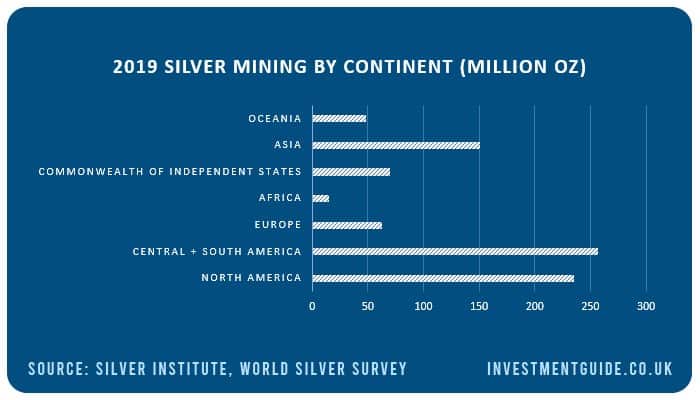

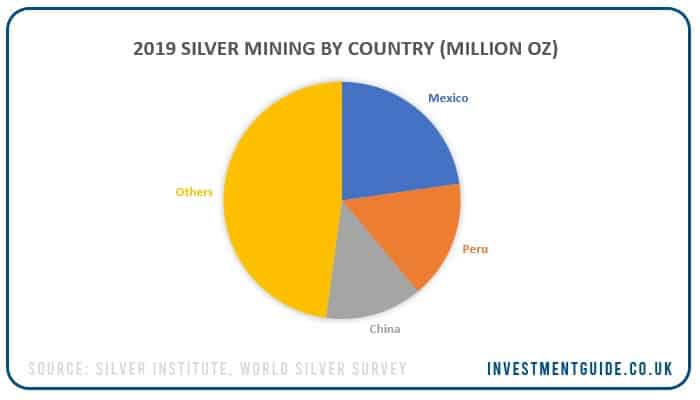

Silver is mined all across the world, but the vast majority of the worlds silver production takes place in the Americas (58.8% of all silver mined in 2019) with Mexico and Peru the two largest individual contributors.

After Mexico and Peru, China is the next largest producer of silver (13.2% in 2019). The remaining 47.8% of silver production in 2019 was attributable to a long tail of producing countries, each contributing no more than 6% of global production.

Interestingly, only 28.7% of silver is mined where silver is the primary source of revenue. The majority of silver is actually extracted as a by-product of mining other metals, as shown in the table below:

| Source metal | Million oz (2019) | % |

|---|---|---|

| Lead/Zinc | 268.7 | 32.1% |

| Primary Silver | 240.0 | 28.7% |

| Copper | 190.6 | 22.8% |

| Gold | 132.1 | 15.8% |

| Other | 5.1 | 0.6% |

This matters if you are considering obtaining exposure to silver prices through acquiring shares in silver mining companies. Why? Because a company which obtains most of its silver as a by-product of mining other metals will be less exposed to silver prices and more exposed to the core metal.

Silver supply vs. demand

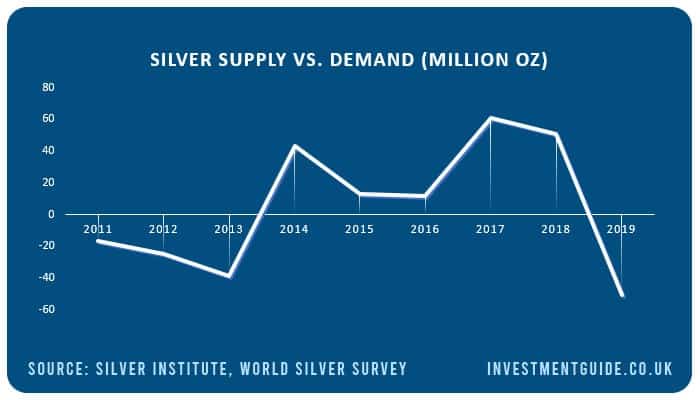

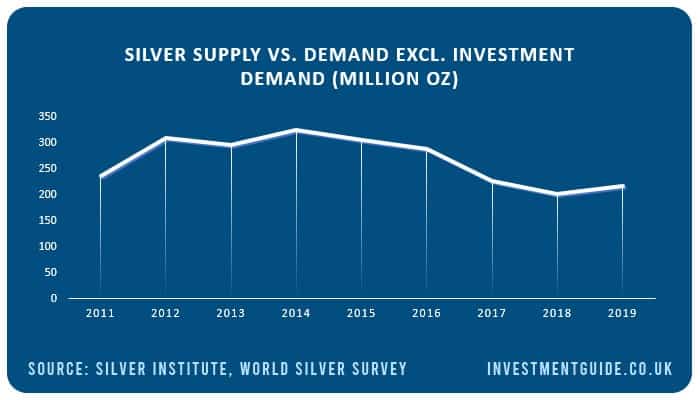

The chart below shows that supply for silver outstripped demand in every year between 2014 and 2018. However, demand outstripped supply in 2019 driven by higher levels of retail investment.

Interestingly though, if we exclude demand for silver for investment purposes, supply has outstripped demand in each of the last 8 years. This illustrates the importance of investor sentiment towards silver as a store of value, because an excess of stored silver coming to market at any one time would likely have a negative impact on silver prices.

Historical silver prices

Courtesy of Bullion Vault, see how the price of silver has fluctuated over time. We have set the chart to show price movements (per oz) over thelast 5 years as default but data is available for the last 20 years.

{{CODEBullionVault}}

How to invest in silver

There are multiple options for investing in silver or gaining exposure to silver prices as part of your wider investment portfolio.

Investing in physical silver

If you are looking to acquire physical silver as a private investor, the two most popular options available are buying directly from the Royal Mint or the Bullion Vault. Both options allow you to buy and store silver safely in secure storage facilities, though The Royal Mint also provides the additional option of storing your silver investment at home.

Royal Mint Bullion

Physical silver can be purchased directly from The Royal Mint which is owned by Her Majesty’s Treasury. The Royal Mint sells both silver bullion bars and limited release silver bullion coins for collectors. When you invest in silver through The Royal Mint, you acquire specific silver bullion bars or coins.

- Silver bullion bars – Available in 10oz (283g), 1kg and 100oz (2.8kg).

- Silver bullion coins – Multiple limited edition 1oz, 2oz and 10oz silver bullion coins are available. These coins are sold at a slight premium to bullion bars of the equivalent weight.

When purchasing silver from The Royal Mint, you can opt to take physical possession of the silver to store at home or you can store it in ‘The Vault’ which is The Royal Mint’s purpose built previous metal storage facility. By storing with The Vault, you can be assured of the safety of your investment as the facility boasts state-of-the-art security systems and 24/7 on-site security. An annual fee of 1.0% (plus VAT) based on the value of the silver bullion you store is charged to use this facility.

Be aware that buying silver from The Royal Mint is not the most cost-efficient way of investing in silver. However, for investors who are concerned about security and have more faith ordering directly from the treasury, it is certainly an option to consider.

When it comes to selling your silver, you can either find a willing buyer on the open market or you can sell it back to The Royal Mint. However, be aware that if you do choose to sell it back to The Royal Mint in the short term, you are likely to make a loss as a wide spread is operated between buy and sell prices.

If you are buying multiple bullion bars/coins, bulk purchase discounts are available directly through The Royal Mint website. When buying silver bullion bars, you pay VAT on the purchase. This is because silver is classed as an ‘industrial’ metal like platinum. The next investment option we discuss is Bullion Vault – note that when you buy silver bullion via Bullion Vault, no VAT is payable.

Bullion Vault

Bullion Vault is the biggest online gold and silver investment platform with over $2 billion in stored bullion.

Bullion Vault offers an alternative way to invest in silver bars. When buying through The Royal Mint, you have the option of taking physical ownership of bullion bars and coins varying in weight from 1oz to 100oz. However, no such option exists with Bullion Vault. This is because the platform enables fractional ownership of silver ‘good delivery bars‘ which weigh 1,000 troy ounces. These far heavier bullion bars would individually exceed the budgets of the vast majority of private investors and are typically traded by miners, refiners, bullion banks, manufacturers and industrial users. By following this model and acquiring silver at wholesale weights and prices, Bullion Vault is able to offer lower pricing than The Royal Mint.

When investing in Bullion Vault, the fees to be aware of are commission fees and storage charges. Commission is payable when initially acquiring silver and is charged at 0.5% on the first $75,000 of purchases with lower fees if investing higher amounts. The same commission is charged when selling silver. However, the savings generated from buying via Bullion Vault will typically more than compensate for this fee.

In addition, storage fees can be far cheaper than The Royal Mint as only 0.04% per month is charged for silver storage, though this is subject to the amount you intend to invest as storage is subject to a minimum charge of $8 per month. Silver is stored in secured vaults and benefits from insurance. Bullion Vault completes daily audits of its holdings, providing daily proof of ownership to investors.

No VAT is payable when investing in silver bullion via Bullion Vault. This is possible because the purchase of ‘Good Delivery Bars’ is zero-rated for VAT provided your bullion does not leave the London Bullion Market Association approved vault.

Investing in silver mining companies

An alternative to directly investing in physical silver is to invest in silver mining companies whose fortunes are heavily influenced by the price of silver. By investing in silver mining companies rather than physical silver, you can potentially drive profits through both dividend payments and capital appreciation, whereas an investment in physical silver relies solely on generating a capital gain.

However, it is worth noting that as silver is often a byproduct of other mining activities, there are few companies which solely concentrate on mining silver. All of the top three silver mining companies by volume (listed below) are involved in the mining of other metals.

| Company | Stock exchange | Ticker symbol |

|---|---|---|

| Fresnillo | London | FRES |

| Glencore | London | GLEN |

| KGHM Polska Miedz | Warsaw | KGH |

Fresnillo operates three mines that are primarily for silver, three for gold, and one that is used for both gold and silver. Glencore produces many other commodities including copper, zinc, and lead, whilst KGHM primarily produces copper.

You can invest in silver mining companies like those listed above using the services of an execution-only platform such as Hargreaves Lansdown (to see a comparison of investment platforms, click here).

Investing in silver ETCs

Silver ETCs either aim track the performance of the silver spot price (price for immediate supply) or future price (price for future supply).

Silver ETCs can track the performance of these prices through either holding physical silver in storage or holding derivatives such as swap agreements.

The below silver ETCs all track the spot price of silver and are backed by physical silver held in storage by a trustee:

| ETC name | Ticker symbol | Tracking | Replication method | Ongoing charge (total expense ratio) |

|---|---|---|---|---|

| iShares Physical Silver ETC | SSLN | Spot price | Physical | 0.40% |

| Invesco Physical Silver ETC | SSLV | Spot price | Physical | 0.39% |

| Xtrackers Physical Silver ETC | XSIL | Spot price | Physical | 0.40% |

To invest in one of these silver ETCs, you can use an execution-only share trading platform such as Hargreaves Lansdown (to see a comparison of investment platforms, click here).

Silver CFDs – trading silver

Certainly not one for beginners, but an alternative way for experienced traders to gain exposure to the silver market is through trading CFDs on silver futures (symbol: XAG) via a trading platform such as Plus 500. CFDs are a leveraged trading product where you can take long or short positions, depending on whether you think the price of silver futures will rise or fall.